Finance Operations Powered by Automation

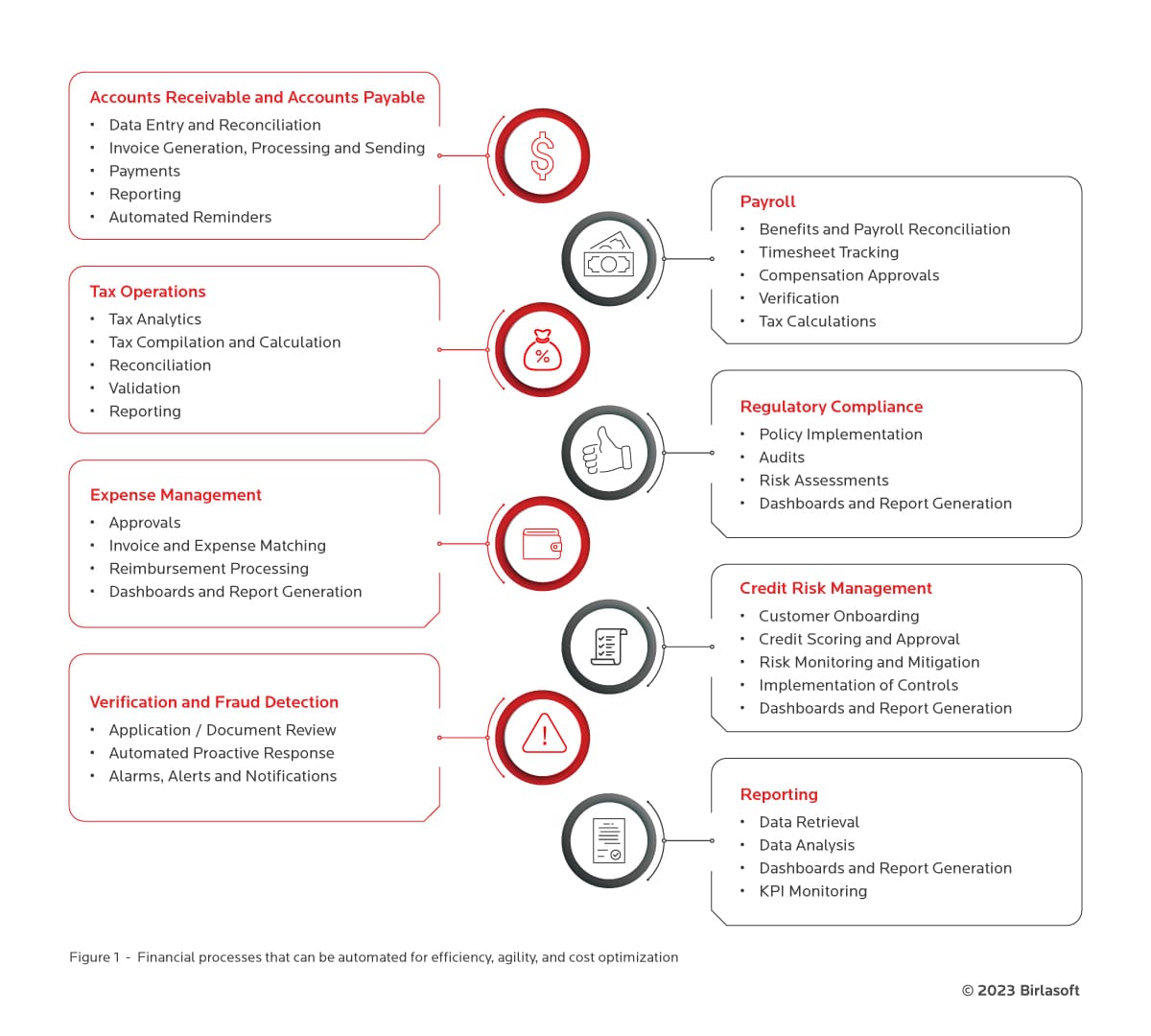

Most of the processes in financial operations involve repetitive standard tasks that must be performed accurately and precisely. Some areas that organizations can automate include the following-

Accounts Receivable (AR) and Accounts Payable (AP)

The processes involved in these areas are tedious, and the chances of errors are high. Introducing automation here in the form of automating the creation and scheduling of invoices, fetching receipts, verifying them with OCR, etc., can free up time for other value-adding tasks. The areas that can be automated in AR and AP include data entry, invoice generation, payments, reconciliation, forecasting, and reporting. Automation can also be implemented for sending reminders, alerts, and notifications to the parties concerned.

Payroll

Automation can be implemented in areas such as timesheet tracking for creating audit trails, compensation approvals, taxes, reporting, and verification. With payroll automation, repetitive tasks such as salary, PTO, and commission calculations can be automated, mitigating human error and sensitive data can be protected better. This can help make financial planning more transparent.

Tax Operations

Tax is another area where there are a lot of tedious standardized processes that can be automated, allowing employees to work on high-priority tasks. Compilation, reconciliation, validation, and analytics of tax data can be automated. Automation can also be valuable in cases where transactions occur in international jurisdictions. Automation can help give the tax function a view of the current state of tax submissions by consolidating data from various sources within the organization. This also helps identify lagging processes and ensures efficiency.

Regulatory Compliance

Automation can help in compliance through uniform policy implementation, audits, risk assessments, and dashboards. Implementing automation in this area can help reduce the incidence of fines and penalties.

Expense Management

Expense management can be a hassle for both the employees filing their expenses as well as the expense management team. However, with automation, the expense filing process is simplified and streamlined. OCR and other technologies can quickly extract data from receipts, verify it and send it along in the standard approval workflow to the expense management team and other parties. Automation can also help in following up on approvals and ensuring that expenses are managed within the timelines.

Reporting and Analysis

Automation can transform reporting and analysis by streamlining the process, retrieving data from multiple sources, analyzing them, and assisting various teams in monitoring desired KPIs through specific dashboards and auto-generated reports. This eliminates the need for following up with various teams for required information and ensuring that the required data and insights are accessible on demand.

Credit Risk Management

Traditional credit risk management involves a lot of human intervention and effort, leading to errors, coordination problems, and non-optimized approaches. With automated risk management, customer onboarding can be quickly completed with online forms, and their credit score is derived using models and algorithms. Employees are empowered to make better credit risk decisions with automated insights extracted from huge volumes of unstructured data and detect and mitigate future risks. Further, this allows the employees to focus on serving the clients instead of spending most of their time doing tedious tasks such as data entry. The correspondence with customers can also be automated with readymade templates. Additionally, the entire process can be standardized with a streamlined workflow, ensuring that the desired controls are implemented at all levels.

Verification and Fraud Detection

With automation, applications and document processing can be automated, followed by verification and fraud detection. Fraud diagnosis, flagging, and mitigation can be automated and notifications and alarms can be sent to the teams involved. Automated responses can be created and leveraged in a proactive approach to fraud detection.

Automation of financial processes allows organizations to avail the following benefits -

- Reducing or eliminating the time spent on tedious tasks, thereby saving time and effort and freeing up time for complex tasks that add value

- Increased accuracy through reduced risk of error and lower manual intervention

- Improved efficiency with streamlined workflows

- Establishing consistency through automated, standardized processes

- Improved collaboration through automated tracking, reporting, and notification systems

- Actionable insights for improved decision-making and strategic implications

- Effectively process unstructured data/documents with intelligent document processing and harness information that would normally require manual effort to collect

- Reduced risk through automated fraud detection and warning systems

Automation, in essence, is accelerating and reshaping financial operations with improved efficiency, agility, resiliency, and visibility. Hence, organizations that want to remain competitive and relevant must decisively step forward, adopt automation, and reap its benefits.