The State of Lending Business

In 2019, a subprime auto-lender was grappling with record low volumes of underwriting, and concerned senior management was busy formulating strategies to boost the volume and move capital faster. Several companies dealt with the same problem during the 2020 pandemic, but with added operational constraints. Manual home loan processing typically takes about 52 days, for example - and this year, loan approval rates have dropped by 50% on an average. In today's digital economy, leading finance companies are capitalizing on vast amounts of consumer data and artificial intelligence to turn the tables around. Artificial intelligence in loan processing turns it instantaneous, cost-effective, convenient, and boost loan volumes in no time. In other words, artificial intelligence holds the keys to thriving in today's cut-throat marketplace that's getting fiercer with the arrival of alternative lending platforms and fintechs.

The Rise of Digital-led Automated Loan Processing

Traditional loan processing usually constitutes manual reviewing of documents for risk profiling, credit review, underwriting, servicing, and delinquency management. The manual nature of these operations results in significantly high costs for the lenders. It could manifest in the form of expensive employee-hours, lost time, and bad customer experience. However, in a digitally interconnected world, these processes have become obsolete and are a significant roadblock for the lenders who want to achieve high profitability in the lowest possible time. Personal and business credit customers alike want a seamless and lightning-fast loan approval and fund disbursement process. Observing this puzzle in the context of increasingly massive amounts of customer data, Fintech companies took the lead and gave birth to artificial intelligence and automation-based lending.

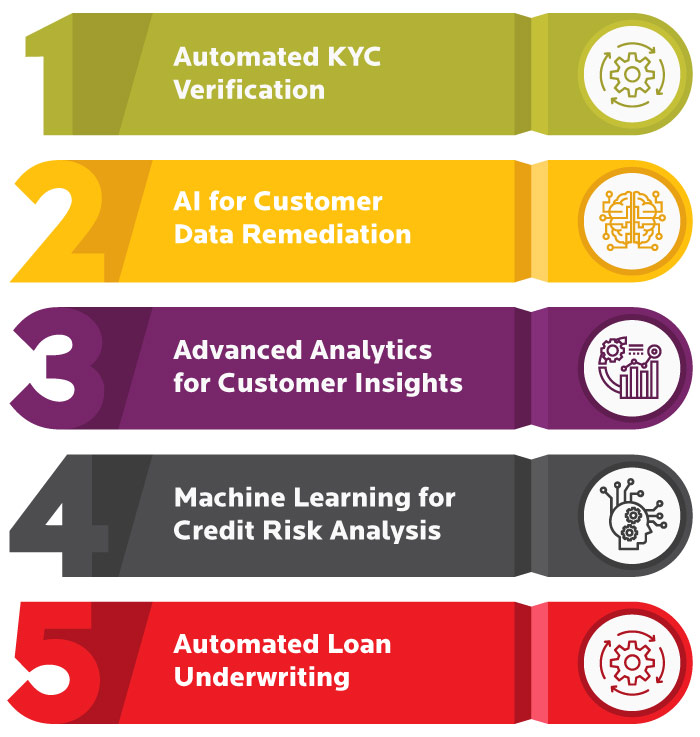

Driving Digital Transformation in Lending with Artificial Intelligence and Automation

Automated KYC Verification

Automated KYC processing leverages computer vision technologies. These advanced technologies use deep learning models for processing image and biometric data, and 3rd party cloud services for cross-validating data from multiple sources. Coupled with end-to-end automation of the KYC process, lenders can now reduce the traditional 2-3 days long, manual and physical process to an instantaneous, low-touch digital process. In addition to surging onboarding rates, automated, artificial intelligence-assisted KYC verification can eliminate human error and massively reduce onboarding costs.