The transition to SaaS-based ERP

Over a while, SaaS-based ERP has become a default option for finance in small and mid-sized businesses. The transition has brought down the costs, primarily because the solution gives the luxury of more configuration capabilities and support resources. Some organizations still use a mixed model (an on-premises legacy application integrated with multiple Cloud solutions), but overall, SaaS is witnessing significant adoption among CFOs.

According to Gartner, there is a clear shift from on-premise to Cloud. By 2025, 80% of midsize and 45% of large financial application projects will be deployed on the Cloud.

Selecting the suitable SaaS-based ERP

SaaS ERP is more cost-effective than on-premise systems. However, before deciding, CFOs should factor in the Total Cost of Ownership (TCO), which includes subscription fees, customization costs, and ongoing maintenance & support costs.

That being said, TCO is not the ultimate criterion. It should be about creating business value. For example, you can think of the shareholder value, what are the opportunities for your company to be more competitive or create significant differentiation?

Your priority might be to free up your working capital, where SaaS-based ERP can help you improve operations like procure-to-pay, project-to-close, tax deductions, etc.

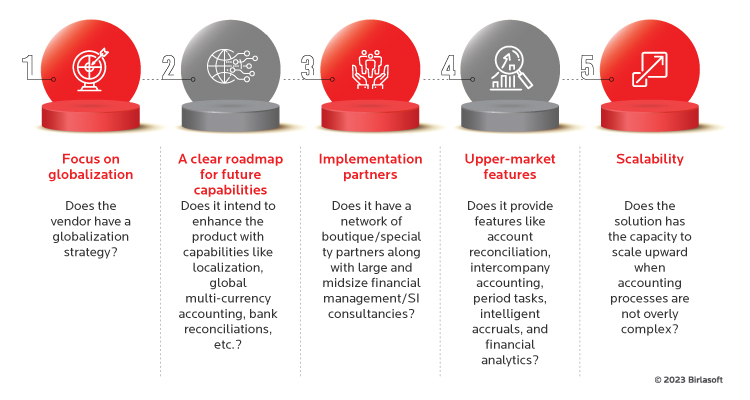

The other factors you should take into consideration include:

- Focus on globalization – Does the vendor have a globalization strategy?

- A clear roadmap for future capabilities – does it intend to enhance the product with capabilities like localization, global multi-currency accounting, bank reconciliations, etc.?

- Implementation partners - does it have a network of boutique/specialty partners along with large and midsize financial management/SI consultancies?

- Upper-market features – does it provide features like account reconciliation, intercompany accounting, period tasks, intelligent accruals, and financial analytics?

- Scalability – does the solution has the capacity to scale upward when accounting processes are not overly complex?